Tikit SmartLoan

Processing Software

A lightweight, affordable solution to simplify your loan process for all parties involved. And it’s customizable to fit your process and brand.

The loan process is complex and bulky, and has inherent gaps and problems. Keeping all parties in the loop is difficult and consumes your time and energy. Tikit solves these problems for you. Robust features like preset SmartLists, communication tools, reminders and progress indicators keep track of everything for you and make it easy for borrowers, brokers, loan officers, processors, and agents to know exactly where the loan is at any time, on any device.

Cloud-Based Loan Processing Software

Tikit SmartLoan makes processing your loans streamlined and easy, keeping everyone on the same page, with things like:

Favorite Uses

Email, text and keep track of all communications in each loan. Email and text templates make it super fast.

How Does it Work and What is the Process?

- A broker or loan officer takes an application from a new borrower, which is then entered into Tikit.

- The new loan is then created and assigned to a processor.

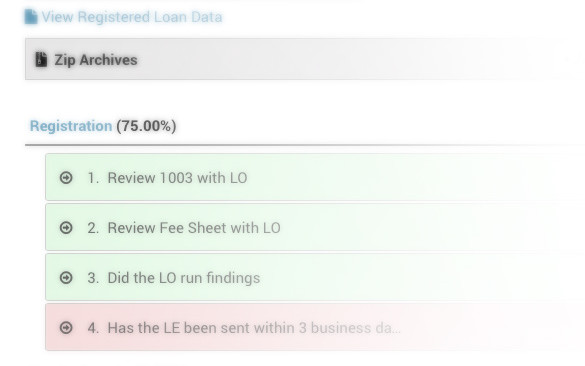

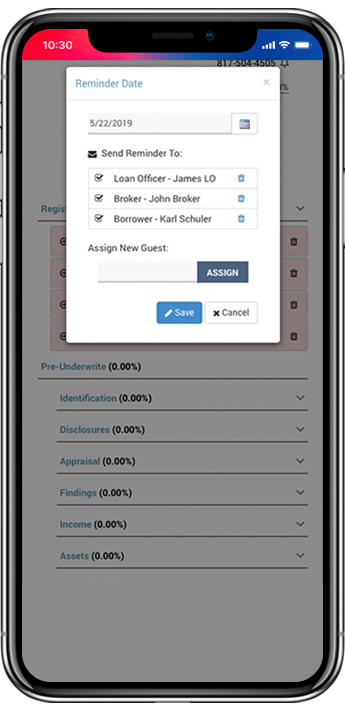

- The processor determines what conditions are needed and adds them through the SmartList, which sets up each condition with target dates, reminder date placeholders, and assigned parties or “guests.”

- Text and email reminders are sent out to each guest using the built-in email and text templates, based on the preferences set by the processor. Tikit comes with a number of built-in email and text templates you can edit and use again and again right from the dashboard, or create your own.

- Borrowers access their secure dashboard to provide documents needed.

- The Daily Report page shows the processor which conditions are coming due today and of highest priority, based on the target date and reminder date.

- The processor confirms the conditions and marks each as completed, which updates the loan progress bar and status charts for all parties to see.

- If an item is rejected, the processor can easily send a text and email message to the borrower for a new document using the Rejected email and text template, right from the loan dashboard.

- Once all conditions have been met, the processor can zip all files and share an encrypted link for the underwriter or others to download.

- Take the rest of the day off, because closing will be days sooner than expected!

Streamlined Loan Processing

With every loan time and communication are of highest importance. We’ve tackled the most difficult challenges in the loan process and made them simpler and easier, creating a frictionless process for borrowers, brokers, lenders, loan processors and real estate agents. With Tikit you can improve quality while increasing quantity and efficiency.